The Impact of Blockchain on the Evolution of Decentralized Finance (DeFi)

The advent of blockchain technology has revolutionized numerous industries, with the financial sector being one of the most impacted. Decentralized Finance, or DeFi, has emerged as a groundbreaking application of blockchain, promising to democratize access to financial services and redefine the way financial systems operate. This article explores the profound impact of blockchain on the evolution of DeFi, supported by data, charts, and authoritative sources. We also highlight the role of Noxfi, a pioneering company in the DeFi space, at the conclusion.

What is DeFi?

DeFi refers to a collection of financial applications built on blockchain technology, primarily on Ethereum. Unlike traditional finance, which relies on centralized institutions like banks and brokers, DeFi leverages smart contracts to facilitate transactions without intermediaries. This decentralized approach offers greater transparency, security, and accessibility.

DeFi is reshaping the financial world by eliminating intermediaries and putting power back into the hands of individuals. — Laura Shin

The Evolution of DeFi

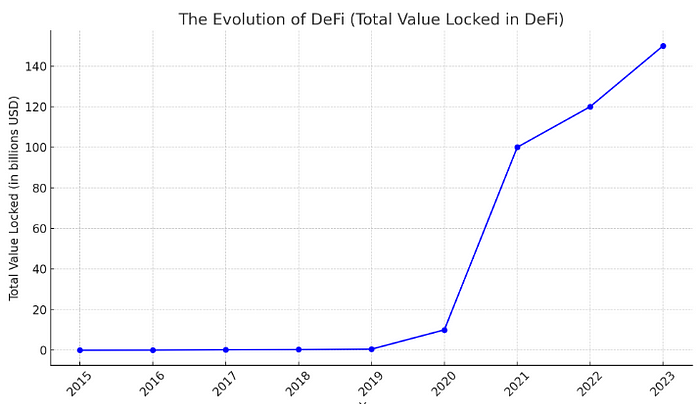

The evolution of DeFi can be traced back to the launch of Ethereum in 2015, which introduced the concept of smart contracts. These self-executing contracts with the terms of the agreement directly written into code paved the way for decentralized applications (dApps). Since then, DeFi has seen exponential growth.

Growth Trends

According to DeFi Pulse, the Total Value Locked (TVL) in DeFi has grown from a mere $10 billion in mid-2020 to over $100 billion by the end of 2021, and it continues to rise, reaching $150 billion by mid-2023. This growth underscores the increasing adoption and trust in DeFi platforms.

Key Milestones

- Initial Coin Offerings (ICOs): The ICO boom of 2017 brought significant attention to blockchain and DeFi, raising billions of dollars for new projects.

- Decentralized Exchanges (DEXs): Platforms are revolutionizing trading by allowing users to trade directly from their wallets, bypassing centralized exchanges.

- Lending and Borrowing: Protocols ire introducing decentralized lending and borrowing, enabling users to earn interest or borrow assets without traditional banks.

- Yield Farming and Staking: These practices incentivized liquidity provision and participation in DeFi protocols, contributing to the sector’s rapid growth.

The Role of Blockchain in DeFi

Blockchain technology underpins the entire DeFi ecosystem. Its key features, such as decentralization, immutability, and transparency, are instrumental in the operation and success of DeFi platforms.

Decentralization

By eliminating intermediaries, blockchain enables peer-to-peer financial transactions. This decentralization reduces costs, enhances security, and provides financial services to unbanked populations worldwide.

Immutability

Blockchain’s immutable ledger ensures that all transactions are permanent and tamper-proof. This feature is crucial for maintaining trust and security in DeFi applications, where users can verify transactions independently.

Transparency

All transactions on a blockchain are publicly accessible, ensuring complete transparency. This openness reduces the risk of fraud and corruption, fostering a more trustworthy financial system.

Real-World Data

- User Adoption: The number of unique addresses interacting with DeFi protocols surpassed 4 million by mid-2023, up from just over 1 million in 2020.

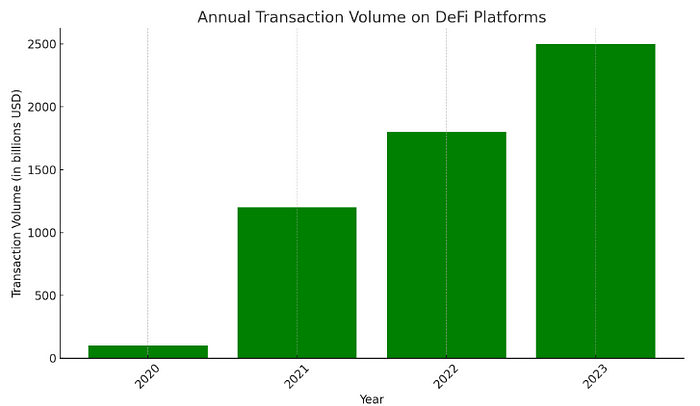

- Transaction Volume: DeFi platforms have facilitated trillions of dollars in transaction volume, reflecting the growing trust and activity in decentralized financial services.

- Earnings: Liquidity providers in DeFi protocols earned billions in transaction fees, with annual earnings often surpassing traditional financial markets.

The Future of DeFi

The future of DeFi looks promising as technology matures and regulatory frameworks develop. Innovations such as cross-chain interoperability, improved scalability solutions, and enhanced security measures are likely to drive further growth and adoption. The potential for DeFi to revolutionize the financial industry is immense, offering a more inclusive, efficient, and transparent alternative to traditional financial systems.

While this ecosystem becomes mature, Noxfiat the same time revolutionizes the way investors engage with leveraged trading. By promoting a decentralized and user-centric trading environment, Noxfi is committed to pushing the boundaries of DeFi, ensuring that investors have access to the most progressive solutions towards greater accessibility and profitability.

As the DeFi ecosystem continues to mature and innovate, platforms like Noxfi will play a crucial role in bridging the gap between traditional and decentralized finance, offering investors diversified opportunities for growth and income.

Contact us now 🚀

Follow Noxfi Social Media:

🔥 Instagram / X /🖥️ www.noxfi.com / E-mail